We invest sustainably, here’s how

Our clients are overwhelmingly pension funds. The youngest members of these pension funds may be over 50 years away from retirement. Many of them will have families who will live into the next century.

Our approach is investment-led, grounded in science and ambitious. We focus on where we can practically make a difference.

Here, we set out our approach across our three categories of investment activity: internally-managed return-seeking portfolios, externally-managed return-seeking portfolios and hedging investment liabilities.

Internally-managed return-seeking portfolios

At Cardano, we manage the most liquid part of clients’ growth portfolios in house; through our multi-asset, scenario-based framework.

This strategy includes allocations to equities, credit, commodities, government bonds and inflation protection. Our aim is to achieve stable, predictable and sustainable returns, through all phases of the economic cycle.

We typically use highly liquid, passive, low-cost building blocks to construct this strategy. From a sustainability perspective, we prefer physical exposure where possible, in order to maximise our real-world impact through engagement and influence.

We have an internally managed framework that assesses and monitors investments closely on sustainability criteria as follows:

- Equity: We are actively invested in custom baskets of stocks that will benefit from the transition to a low carbon economy. We also invest in low-carbon physical equity, with strong ESG integration

- Credit: We invest in high-quality corporate bonds which are subject to direct analysis of their ESG credentials

- Inflation: We do not invest in direct commodity-related fossil fuel exposure

- Recession (government bonds): We have implemented a sustainable bond framework for our green bond selection. To discuss our sustainable bond framework, get in touch with Keith Guthrie: K.Guthrie@cardano.com

In addition, we are exploring the use of sustainable derivatives through the course of 2021 and will publish our analysis as we go.

Externally-managed return-seeking portfolios

We also invest in highly-skilled active managers, seeking significant value-add after fees.

Key principles

- ESG considerations are fully embedded in our manager selection and monitoring process.

- We have one approach that encompasses all external manager strategies, with a minimum set of sustainability standards applied to all managers.

- We recognise that ESG issues have a greater impact on some investment strategies than others and that some managers are able to exert a higher degree of influence and engagement than others.

- We believe in engaging with all of our managers. We give actionable feedback on areas where they can improve their approach to sustainable investment.

Manager Assessment

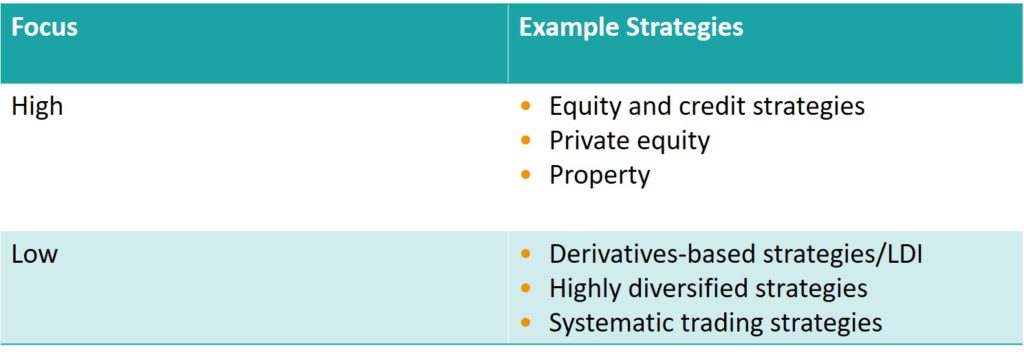

We categorise investment strategies into high and low focus:

Managers investing directly in single name equities and credit will have greater focus from a sustainability perspective than managers investing synthetically through derivative instruments. This is because they have a greater ability to engage and influence.

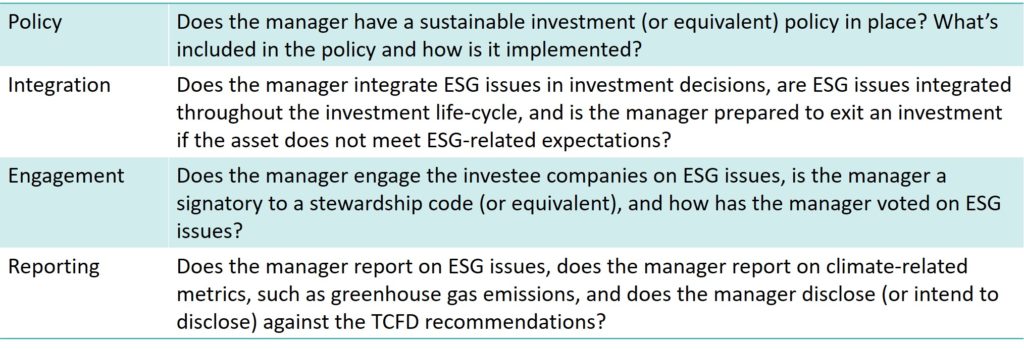

All managers are assessed across four areas:

Based on our assessment we score the manager:

- Strong

- Good

- Standard

- Weak

Over time we aim to increase the portion of our portfolios in “Good” and “Strong” rated managers. Any High Focus managers who are rated weak will have clear engagement plans with milestones they must meet or we will disinvest.

Read our UN Principles for Responsible Investment case-study, here.

Hedging investment liabilities

Hedging changes in interest rates and inflation is known as liability driven investment.

The aim is to do this with as little risk as possible with high-quality fixed income assets.

The key considerations for sustainable liability driven investments are as follows:

- First, green, social or sustainable bonds suit liability driven investment. We favour assets where the proceeds are invested in green or social objectives, which are independently verified, and where we can source at acceptable yields in both new issuances and secondary markets. We also assess the ESG rating of the issuer. We do this using MSCI and Bloomberg ESG analytics

- Second, where we are entering into a derivatives transaction, we undertake an internal assessment of the ESG rating of the counterparty. If the counterparty does not meet our and the client’s minimum ESG standards we will not trade with that counterparty

- Third, as a significant investor in sovereigns and sovereign-related entities, we engage with national policymakers and regulators, including debt management offices on sustainability issues, such as about TCFD reporting.

We will support – and proactively offer – client solutions should they wish to further pursue impact investing in their liability driven investment portfolios.