- Home

- Our approach to Sustainability

- Our approach to Sustainable Investment

- A fairer society

A fairer society

Approach to Social Foundations and a Fairer Society

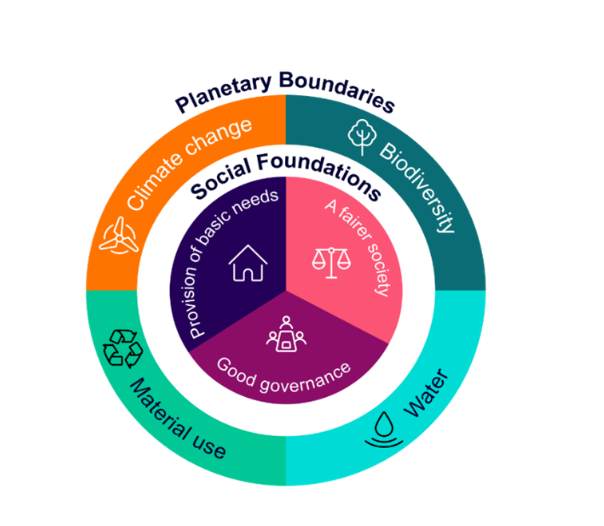

We aim to deliver financial outcomes at the individual investment level, and to contribute to the transition to a more sustainable society that benefits the economy, the environment and society. We believe this approach will ultimately deliver better financial outcomes at a portfolio level for our clients. To do this, we encourage companies to focus on four core planetary boundaries and three social foundations:

Planetary Boundaries:

-

- Fighting climate change

-

- Halting biodiversity loss and deforestation

-

- Using water sustainably

-

- Managing scarce resources, limiting pollution and the transition towards a circular economy

Social Foundations:

-

- Provision of basic needs – ensuring clean water, nutritious food, healthcare, housing, energy and financial services are accessible and affordable

-

- Transition to a fairer society – addressing inequality through access to education and training, income and work, improved diversity, and gender equality in the workplace

-

- Strong governance – this is vital for businesses to maintain their social licence to operate and for governments to maintain their democratic legitimacy

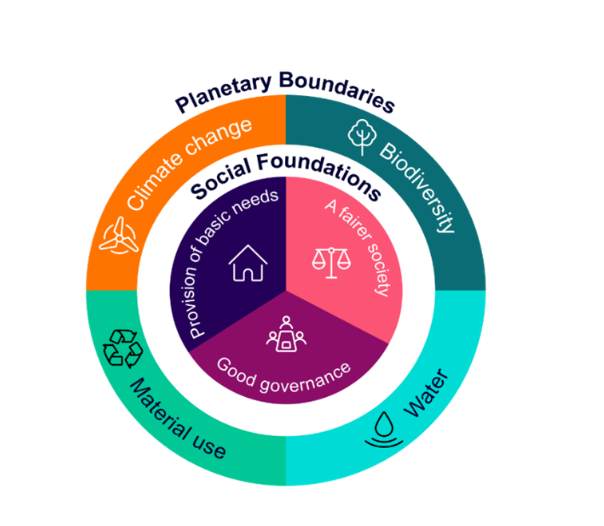

Planetary Boundaries:

-

- Fighting climate change

-

- Halting biodiversity loss and deforestation

-

- Using water sustainably

-

- Managing scarce resources, limiting pollution and the transition towards a circular economy

Social Foundations:

-

- Provision of basic needs – ensuring clean water, nutritious food, healthcare, housing, energy and financial services are accessible and affordable

-

- Transition to a fairer society – addressing inequality through access to education and training, income and work, improved diversity, and gender equality in the workplace

-

- Strong governance – this is vital for businesses to maintain their social licence to operate and for governments to maintain their democratic legitimacy

But how do we approach addressing the social foundations? Here are some examples:

Basic needs: it starts with human rights

Companies we invest in must meet our minimum expectations and comply with the UN Guiding Principles on Business and Human Rights, the OECD Multinational Enterprise Guidelines, the International Labor Organisation labour standards, and UN Global Compact.

Companies must also be transparent about how they:

- contribute to human rights and the living standards of communities affected by their operations

- secure the proper wellbeing of their employees or inhabitants

- protect against social injustice and inequality

- follow principles of suitable governance, good human capital management

We also expect companies to develop policies that address core issues, such as how to mitigate modern slavery risks in supply chains.

And we will exclude companies from our portfolio that violate the UN Global Compact, and don’t comply with basic human rights including labour rights, modern slavery and child labour.

Basic needs: it starts with human rights

Companies we invest in must meet our minimum expectations and comply with the UN Guiding Principles on Business and Human Rights, the OECD Multinational Enterprise Guidelines, the International Labor Organisation labour standards, and UN Global Compact.

Companies must also be transparent about how they:

- contribute to human rights and the living standards of communities affected by their operations

- secure the proper wellbeing of their employees or inhabitants

- protect against social injustice and inequality

- follow principles of suitable governance, good human capital management

We also expect companies to develop policies that address core issues, such as how to mitigate modern slavery risks in supply chains.

And we will exclude companies from our portfolio that violate the UN Global Compact, and don’t comply with basic human rights including labour rights, modern slavery and child labour.

Basic needs: health

Good health ensures individuals, workforces, communities and economies can thrive. Our engagements on health link to basic needs accessibility and our Sustainable Investment Policy.

We believe food manufacturers and retailers should ensure the healthiness of their products and contribute towards tackling obesity. To increase the choice of affordable, healthier food and to reduce systemic risks related to a lack of affordable, nutritious food, we collaborate with companies in the food industry via the Access to Nutrition Initiative (ATNI) and the ShareAction Healthy Markets Initiative.

We’ve helped form the Health Engagement Alliance (HEAL) for companies to progress on key health-related topics, and are focused on:

- Governance: setting up a lobbying policy and code of conduct, ensuring companies do not lobby against their own commitments on health and nutrition

- Accountability: creating a policy on healthy diets including targets

- Responsible marketing: progressing labelling and accessibility of nutrition information

Basic needs: health

Good health ensures individuals, workforces, communities and economies can thrive. Our engagements on health link to basic needs accessibility and our Sustainable Investment Policy.

We believe food manufacturers and retailers should ensure the healthiness of their products and contribute towards tackling obesity. To increase the choice of affordable, healthier food and to reduce systemic risks related to a lack of affordable, nutritious food, we collaborate with companies in the food industry via the Access to Nutrition Initiative (ATNI) and the ShareAction Healthy Markets Initiative.

We’ve helped form the Health Engagement Alliance (HEAL) for companies to progress on key health-related topics, and are focused on:

- Governance: setting up a lobbying policy and code of conduct, ensuring companies do not lobby against their own commitments on health and nutrition

- Accountability: creating a policy on healthy diets including targets

- Responsible marketing: progressing labelling and accessibility of nutrition information

Financial security for all

We aim to achieve wellbeing and financial security in old age for pension fund members and their families in an equitable and safe society that respects and supports human rights.

now: pensions, our sister company, has developed policy engagement with the UK Government to drive fair pensions for all, focused on the real Living Wage and gender equality. We are proud to support now: pensions as its appointed investment manager, engaging with companies in its investment portfolio on these important topics

Financial security for all

We aim to achieve wellbeing and financial security in old age for pension fund members and their families in an equitable and safe society that respects and supports human rights.

now: pensions, our sister company, has developed policy engagement with the UK Government to drive fair pensions for all, focused on the real Living Wage and gender equality. We are proud to support now: pensions as its appointed investment manager, engaging with companies in its investment portfolio on these important topics

Paying a real Living Wage

Companies that pay a real Living Wage – based on actual living costs – can mitigate legal risks, enhance business performance and foster social stability, reducing long-term systemic risk. We encourage companies to:

- pay a real Living Wage to all direct employees

- improve oversight of regular third-party contracted worker staff pay levels and pay them the real Living Wage become accredited as a Real Living Wage Employer with the Living Wage Foundation.

As an active member of the ShareAction Good Work Coalition, we encourage good working practices, the real Living Wage, and diversity and inclusion.

Paying a real Living Wage

Companies that pay a real Living Wage – based on actual living costs – can mitigate legal risks, enhance business performance and foster social stability, reducing long-term systemic risk. We encourage companies to:

- pay a real Living Wage to all direct employees

- improve oversight of regular third-party contracted worker staff pay levels and pay them the real Living Wage become accredited as a Real Living Wage Employer with the Living Wage Foundation.

As an active member of the ShareAction Good Work Coalition, we encourage good working practices, the real Living Wage, and diversity and inclusion.

Sustainable emerging markets

We’re investing to create real-world impact, driving capital flow to private impact investment in emerging markets. Impactful change can be most meaningful for people who are most vulnerable to the effects of climate change and biodiversity loss – and unfortunately many of these are in the emerging markets.

We’ve invested in financial inclusion since 2007, when we launched our first microfinance strategy, followed by our second strategy in 2008. We focus on strengthening financial inclusion of underserved communities through facilitating the flow of private funding to emerging market financial institutions used for microlending and SME lending.

In 2023, our financial inclusion strategies invested in the Philippines and the Dominican Republic for the first time, targeting female entrepreneurs, rural communities and people living in poverty. 72% of people reached by the financial institutions in our portfolio were low-income women.

From contributing to social objectives investable via our private impact strategies to our stewardship activities voting on board diversity and shareholder resolutions, to engaging with companies to develop their own policies on diversity and pay, we aim to contribute to social foundations.

Sustainable emerging markets

We’re investing to create real-world impact, driving capital flow to private impact investment in emerging markets. Impactful change can be most meaningful for people who are most vulnerable to the effects of climate change and biodiversity loss – and unfortunately many of these are in the emerging markets.

We’ve invested in financial inclusion since 2007, when we launched our first microfinance strategy, followed by our second strategy in 2008. We focus on strengthening financial inclusion of underserved communities through facilitating the flow of private funding to emerging market financial institutions used for microlending and SME lending.

In 2023, our financial inclusion strategies invested in the Philippines and the Dominican Republic for the first time, targeting female entrepreneurs, rural communities and people living in poverty. 72% of people reached by the financial institutions in our portfolio were low-income women.

From contributing to social objectives investable via our private impact strategies to our stewardship activities voting on board diversity and shareholder resolutions, to engaging with companies to develop their own policies on diversity and pay, we aim to contribute to social foundations.