Bank of England maintains resolve to fight inflation – fiscal policy remains key

Today’s 0.5% hike in Bank Rate by the Bank of England matched market expectations. Expectations for where the Bank Rate eventually settles have been increasing throughout 2022. The most recent increases have come off the back of a greater realisation that the Bank is likely to lean heavily against the inflationary implications of the Government’s fiscal plans.

The vote was split 3 ways. 5 members voted for 0.5%, 3 voted for 0.75% and 1 for 0.25%. The more hawkish dissenters preferred more forceful action now focusing their attention on the tightness of the UK labour market, the persistence of current inflation trends and upside risks. The single dovish dissenter noted that economic activity already was showing signs of weakness.

The trajectory of UK monetary policy remains in line with the similarly tighter policy settings being put in place by most of the world’s major central banks. Yesterday, the Federal Reserve hiked the effective Federal Funds rate by 0.75% and reiterated its intent to persevere with tighter monetary policy. Notably Fed chair Powell remarked that he saw; “[no] painless way” to “get inflation behind us”. Both the Bank of England and the Federal Reserve are overtly prioritising the fight against inflation over support for growth in their domestic economies.

In the UK, we will hear more about fiscal policy tomorrow from Chancellor Kwarteng. However, even before the details of the mini-budget are released, it is clear that the deficit spending that is implied by the energy price cap policy is going to exacerbate the UK’s twin deficit problem. Easing the tax take will only make things worse. That’s more bad news for Sterling which earlier this week fell to its lowest level against the US dollar since 1985. The Bank of England however is reserving its opinion on the implications of fiscal policy adjustment just now – a fuller assessment will come in November.

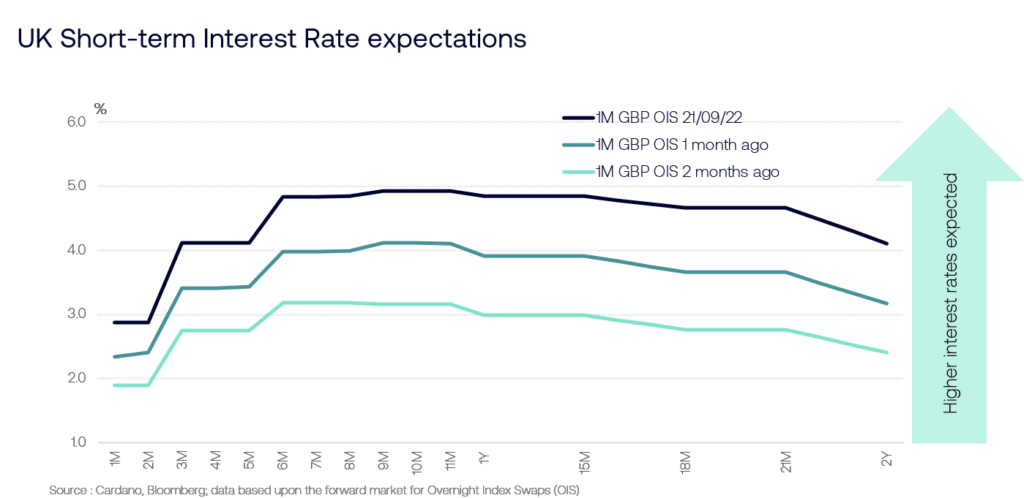

Whilst the Bank of England is maintaining its hawkish bias it is not outpacing the Federal Reserve. The market is expecting both central banks to be hiking into 2023 but, importantly, the Bank of England is not expected to open up a significant positive interest rate differential – a key factor that might otherwise provide some respite from Sterling’s depreciation.

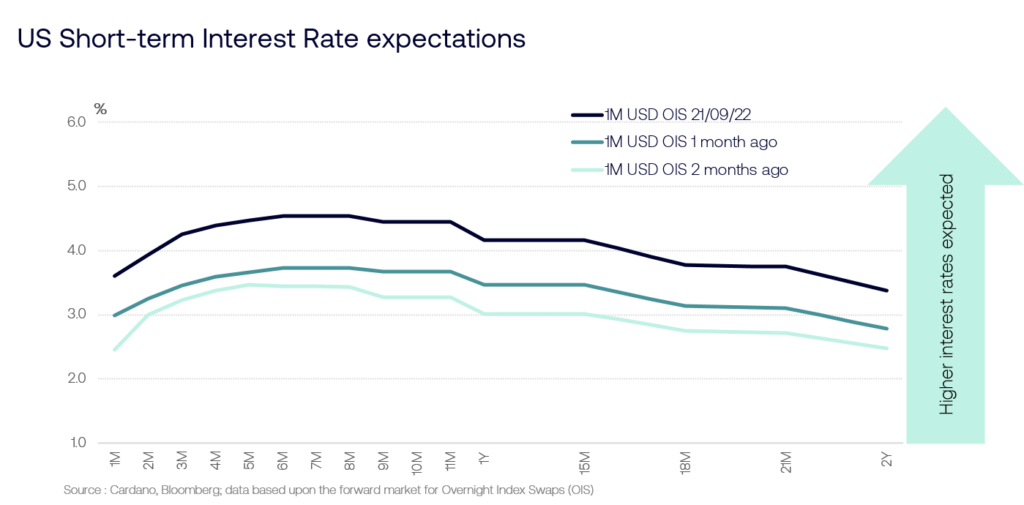

The graphs below illustrate how market expectations, of where short-term interest rates could go over the next 2 years, have changed. They highlight the increase in expectations over the Summer and the expectation that Sterling is unlikely to benefit from a significantly positive interest rate differential effect until well into 2023.

The UK has some tough times ahead;

- An increasing budget deficit will require financing in a bond market that is still dominated by unattractive negative real yields and at a time when the Bank will be selling government bonds held on its balance sheet. This contrasts with the situation in the US where Fed chair Powell has said that “positive real rates across the yield curve” are an important consideration for restrictive monetary policy

- Energy price caps and proposed tax cuts are going to preserve demand in the economy and, with a tight labour market, risk the further onset of a wage-price spiral. Also, the open-ended nature of the support promised could be problematical for the gilt market

- Sterling is biased toward further depreciation risking a fresh inflationary impulse because of the UK’s trade position

In this stagflationary environment, the only bright spot is that the FTSE (already one of the better performing global stock indices this year) is well supported by earnings that are flattered by a depreciating domestic currency.