Carpe Diem – are corporate sponsors ready to “seize the day”?

Has the tide finally turned? Are corporate sponsors taking the opportunity to “seize the day” and re-shape their pension strategy?

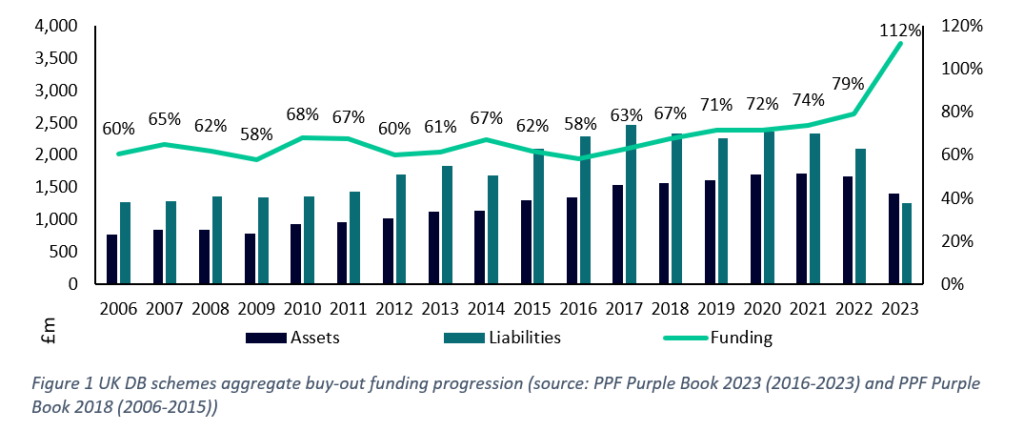

Despite the turmoil of the Gilts crisis in September 2022, most pension schemes have weathered the storm and found themselves in a better funding position. August data from the Pension Protection Fund (PPF) shows that of the 5,050 defined benefit schemes, 4,587 are in PPF-funding surplus to the tune of £475bn. Funding on a buy-out basis is also now in surplus (see Figure 1 below).

For many CFOs and Group Treasurers the improvement in funding has allowed pension risk to fall down the agenda; however corporate sponsors would be wise to take advantage of current market conditions and the regulatory environment to reset the dial with pension trustee boards.

After 20 years in which pensions were a constant source of pain for CFOs and Treasurers, we have moved into a world of opportunity: employers now have the opportunity of finally being able to remove pension schemes from balance sheets, or even access and share some of the surpluses built up in their pension scheme. Yet many sponsors have yet to work out what this new world means for them: a recent survey by Cardano of over 200 CFOs showed that 89% of CFOs were unsure whether the company had the potential to access a future surplus.

Sponsors should take time to think carefully about taking advantage of a number of tailwinds and seize the day with regard to their pension strategy.

Why is now a good time and what should corporate sponsors focus on?

-

Endgame options

-

Surplus extraction

-

Actuarial valuations

-

New Funding Code

Rethinking endgame options

- Reaching self-sufficiency funding and possibly full funding on a buyout basis may now be achievable in a much shorter timeframe. Revise and be clear about corporate objectives with regard to your pension scheme.

- For the first time, employers and trustees will be required to agree and document their long-term objective for the pension scheme.

- New entrants into the insurance market, and new guidance from The Pensions Regulator (TPR) around superfunds and capital backed funding arrangements highlight the interest from capital providers to find solutions, widening the range of options available.

- There is growing discussion of run-on – is this now more viable as pension risk has reduced and there is an opportunity to access and even grow the pension scheme surplus over the long term?

Surplus extraction

- Under the previous Government, the Department of Working Pensions (DWP) consulted on options for Defined Benefit (DB) pension schemes, looking to make it easier to share scheme surplus with employers and scheme members. Although the General Election has changed the landscape, the new Labour Government appears to share many of the last Government’s principles around “productive finance”.

- Sponsors can already benefit from the reduction in tax on surplus from 35% to 25%.

- The pension scheme trust deed and rules should be checked to understand the art of the possible.

- What are your plans for a possible share of the surplus – fund a buyout, fund DC contributions, improve DB benefits, invest in the business?

Actuarial valuations – don’t assume there’s nothing to do. Now is the time to re-set the dial.

- If a valuation is more than a year away, should a new interim contribution schedule be prioritised and agreed now?

- In the light of improvements what level of funding should now be targeted?

- Is the credit support package now too generous?

- Should the scheme now be covering more of its costs?

- How significant is the pension scheme as a creditor? What impact does it have on cashflow? How does the pension scheme impact dividend payments and capex plans – is the removal of the scheme from the balance sheet now the right option?

- Schemes are now proportionally smaller; balance between deficit repair contributions vs. returns from investment risk should be right-sized.

Funding Code – corporate sponsors are well placed to take advantage

- The new Funding Code gives scope for corporate sponsors to push back on proposed contribution levels if they can demonstrate that those will impact on the sponsor’s sustainable growth.

- Long-term targets must be agreed, but may not need to be as onerous for sponsors as the voluntary targets adopted in the past.

- The employer is given a voice in setting the long term target, and should consider how the target fits with its views on appropriate levels of investment risk. The regulations only require schemes to be fully funded on a low dependency basis at the point of significant maturity, rather than needing to adopt a low dependency investment strategy.

- Journey plans should be set with reference to the strength of the sponsor covenant and its risk capacity – the sponsor can challenge the trustees if there is a difference in the perceived strength of the sponsor, to ensure that the journey plan better reflects the long-term strength of the company.

Please speak to a member of the Cardano Corporate Advisory team if you would like help framing any or all of these points with your trustee board. We always aim to work collaboratively to achieve the optimal outcome for corporate sponsors and members.