Our approach to Sustainable Investment

Sustainability is at the heart of how we run our business. We believe we can contribute to the transition to a sustainable society – a fairer society with strong social foundations that operates within environmental boundaries; one where people, businesses and nature can prosper, that offers a decent quality of life and provides financial security.

The world faces many sustainability challenges, which are driving long-term economic and societal systemic risks. We need multiple transitions to create a sustainable society, creating both investment risks and opportunities.

Our comprehensive approach to sustainable investing addresses financial risks and real-world impacts of these transitions – in other words, we follow a ‘double materiality’ approach.

We focus our resources on driving change in areas that we are passionate about, where we are knowledgeable, and where we can have an impact.

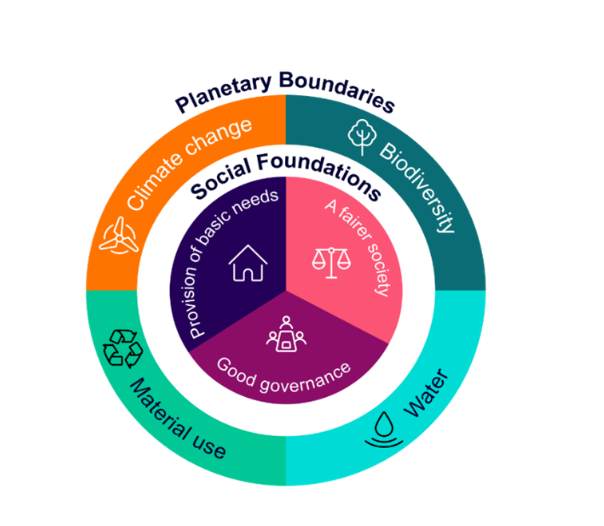

We’ve identified 4 environmental themes and 3 social foundations to support the transition to a sustainable society:

Many challenges facing our society, such as climate change, biodiversity loss or social inequalities, result in systemic risks to the economy. This means they have the potential to impact not only single investments, but also long-term economic outcomes. That will affect long–term financial outcomes for all investors.

As well as staying true to our corporate values, sustainable investment is the right thing to do for our society and our world because it contributes to addressing these long-term systemic risks.

But we also we invest sustainably and incorporate environmental, social and governance (ESG) risk assessment because it:

- Leads to better risk-adjusted outcomes

- Uncovers new investment opportunities

- Allows us to anticipate regulatory and policy changes

Many challenges facing our society, such as climate change, biodiversity loss or social inequalities, result in systemic risks to the economy. This means they have the potential to impact not only single investments, but also long-term economic outcomes. That will affect long–term financial outcomes for all investors.

As well as staying true to our corporate values, sustainable investment is the right thing to do for our society and our world because it contributes to addressing these long-term systemic risks.

But we also we invest sustainably and incorporate environmental, social and governance (ESG) risk assessment because it:

- Leads to better risk-adjusted outcomes

- Uncovers new investment opportunities

- Allows us to anticipate regulatory and policy changes

Our sustainable investment approach

We believe all investments have both financial characteristics like risk and expected returns, and real-world impacts such as contributing towards or detracting from the transition to a more sustainable society.

We consider both the impact of sustainability risks on our investments and the impact of our investments on the real world and on the systemic risks to the economy – in other words, we follow a ‘double materiality’ approach to our investments.

By assessing the real-world contribution of our investments, we understand the risks and opportunities as we transition to a more sustainable society. We incorporate ESG risks and opportunities into our investment analysis, decisions and advice, focusing on where we can be most impactful.

With our capital allocation and stewardship approach, we encourage companies and governments to make the transition towards operating sustainably, within the planetary boundaries and respecting social foundations. We hope to contribute over the long-term to reducing systemic risks: to increase the chances of positive outcomes such as limiting global warming to 1.5 degrees and reduce the chances of more negative scenarios.

Our sustainable investment approach

We believe all investments have both financial characteristics like risk and expected returns, and real-world impacts such as contributing towards or detracting from the transition to a more sustainable society.

We consider both the impact of sustainability risks on our investments and the impact of our investments on the real world and on the systemic risks to the economy – in other words, we follow a ‘double materiality’ approach to our investments.

By assessing the real-world contribution of our investments, we understand the risks and opportunities as we transition to a more sustainable society. We incorporate ESG risks and opportunities into our investment analysis, decisions and advice, focusing on where we can be most impactful.

With our capital allocation and stewardship approach, we encourage companies and governments to make the transition towards operating sustainably, within the planetary boundaries and respecting social foundations. We hope to contribute over the long-term to reducing systemic risks: to increase the chances of positive outcomes such as limiting global warming to 1.5 degrees and reduce the chances of more negative scenarios.

Investing in the transition

As well as investing in companies that operate sustainably, we invest in companies that are willing and capable of making the transition. We will underweight or exclude companies that we believe are unlikely or unwilling to transition or are actively harmful towards the transition.

We believe that investing in the transition will make our investor portfolios more resilient to uncertainty and realise better returns, while achieving sustainable results in the real world. It’s also good risk management, requiring an understanding of complex systems such as the economy and nature.

More information on our approach is here.

Investing in the transition

As well as investing in companies that operate sustainably, we invest in companies that are willing and capable of making the transition. We will underweight or exclude companies that we believe are unlikely or unwilling to transition or are actively harmful towards the transition.

We believe that investing in the transition will make our investor portfolios more resilient to uncertainty and realise better returns, while achieving sustainable results in the real world. It’s also good risk management, requiring an understanding of complex systems such as the economy and nature.

More information on our approach is here.

Our approach to stewardship and collaboration

Our responsibilities don’t stop when we have made an investment. We take our responsibilities as stewards of our clients’ capital seriously.

We engage with businesses that we are invested in (we vote and escalate issues where necessary) to improve their sustainable policies and practices, focusing on stewardship of the systemic risks identified by our Sustainable Investment Framework.

For more information on our approach to stewardship, see here.

Our approach to stewardship and collaboration

Our responsibilities don’t stop when we have made an investment. We take our responsibilities as stewards of our clients’ capital seriously.

We engage with businesses that we are invested in (we vote and escalate issues where necessary) to improve their sustainable policies and practices, focusing on stewardship of the systemic risks identified by our Sustainable Investment Framework.

For more information on our approach to stewardship, see here.

Exploring our sustainability themes

Our investment beliefs drive our activities and outcomes for our clients and enable effective stewardship of our clients’ assets, while supporting the transition and addressing key social foundations and planetary boundaries.

Planetary boundaries:

-

- Fighting climate change

-

- Halting biodiversity loss and deforestation

-

- Using water sustainably

-

- Managing scarce resources, limiting pollution and the transition towards a circular economy

Social foundations:

-

- Provision of basic needs – ensuring clean water, nutritious food, healthcare, housing, energy and financial services are accessible and affordable.

-

- Transition to a fairer society – addressing inequality through access to education and training, income and work, improved diversity, and gender equality in the workplace.

-

- Strong governance – this is vital for businesses to maintain their social licence to operate and for governments to maintain their democratic legitimacy.

Exploring our sustainability themes

Our investment beliefs drive our activities and outcomes for our clients and enable effective stewardship of our clients’ assets, while supporting the transition and addressing key social foundations and planetary boundaries.

Planetary boundaries:

-

- Fighting climate change

-

- Halting biodiversity loss and deforestation

-

- Using water sustainably

-

- Managing scarce resources, limiting pollution and the transition towards a circular economy

Social foundations:

-

- Provision of basic needs – ensuring clean water, nutritious food, healthcare, housing, energy and financial services are accessible and affordable.

-

- Transition to a fairer society – addressing inequality through access to education and training, income and work, improved diversity, and gender equality in the workplace.

-

- Strong governance – this is vital for businesses to maintain their social licence to operate and for governments to maintain their democratic legitimacy.

Biodiversity ambitions

Biodiversity loss is a global systemic risk. Over half of GDP is directly or indirectly dependent on nature. We seek to understand where companies in our portfolios are contributing to biodiversity loss through links to deforestation in their own activities or supply chains. Using innovative data and collaborative initiatives, we engage with companies, governments and regulators to address the drivers of biodiversity loss and support net–zero deforestation by 2030.

Climate commitments

The climate crisis is one of the most fundamental challenges confronting the global economy. We support international goals to limit global warming to 1.5°C above pre-industrial levels. We’ve committed all our investment portfolios to net-zero carbon emissions by 2050, with ambitious interim targets throughout our journey. Our focus is on supporting the transition to net zero in the real economy, as well as in our investment portfolios.

A fairer society

A fair society addresses inequality through access to education and training, income and work, paying a real living wage, respecting labour rights and improving diversity and gender equality. Failure to do so increases systemic risks, leading to political and economic uncertainty. Addressing these social foundations can improve the quantity and quality of economic growth. We encourage companies to focus on these social foundations, and engage with governments and policy makers to develop supporting policies.

Our Sustainability Committee

Kerrin Rosenberg

-

CEO Investments Cardano UK

Dennis van der Putten

-

Chief Sustainability Officer

Keith Guthrie

-

Head of Sustainability UK

Hilde Veelaert

-

Chief Investment Officer Public Markets

Our Sustainability Committee

Kerrin Rosenberg

-

CEO Investments Cardano UK

Dennis van der Putten

-

Chief Sustainability Officer

Keith Guthrie

-

Head of Sustainability UK

Hilde Veelaert

-

Chief Investment Officer Public Markets